Renting Costs UK 2026: Full Breakdown

Renting in the UK has become significantly more expensive in recent years, and 2026 is no exception. Rising rents, increased demand, limited housing supply and higher living costs mean tenants must budget carefully before moving.

This guide explains exactly how much it costs to rent in the UK in 2026, including deposits, upfront costs, monthly rent, ongoing bills, and regional differences. Whether you’re a first-time renter, moving cities, or budgeting as a family, this article gives a realistic picture of what to expect.

Average Monthly Rent in the UK (2026)

In 2026, the average monthly rent in the UK is:

- £950 – £1,200 per month (UK average)

- £1,900 – £2,600 per month (London)

- £700 – £950 per month (Northern England)

Rent depends heavily on:

- Location

- Property size

- Furnished vs unfurnished

- Demand in the local area

Cities and commuter towns continue to see the highest rent increases.

Average Rent by Property Type

Different property sizes carry very different costs.

Room in a shared house

- £450 – £750 per month

- London: £700 – £1,100

1-bedroom flat

- £750 – £1,100 per month

- London: £1,600 – £2,200

2-bedroom property

- £950 – £1,400 per month

- London: £1,900 – £2,800

3-bedroom house

- £1,200 – £1,800 per month

- London: £2,500 – £3,500+

Larger family homes have seen some of the biggest rent increases.

Rental Deposit Costs in 2026

Deposits remain one of the biggest upfront costs.

Legal deposit cap

- Maximum deposit = 5 weeks’ rent

Typical deposit amounts

- £750 rent → £865 deposit

- £1,200 rent → £1,385 deposit

- £2,000 rent → £2,300 deposit

Deposits must be protected in a government-approved scheme.

Outbound link:

https://www.gov.uk/tenancy-deposit-protection

First Month’s Rent (Paid in Advance)

Tenants must usually pay:

- First month’s rent upfront

- Deposit at the same time

This means moving into a £1,200/month property often requires £2,500+ upfront.

Some landlords may also ask for rent paid on a specific date, regardless of move-in day.

Holding Deposit Explained

A holding deposit reserves the property while checks are carried out.

Holding deposit rules

- Maximum: 1 week’s rent

- Must be deducted from move-in costs

- Refundable if landlord withdraws

If the tenant fails referencing or pulls out, the holding deposit may be kept.

Outbound link:

https://www.gov.uk/government/publications/tenant-fees-act-guidance

Letting Agent Fees (What Is Still Allowed?)

Under the Tenant Fees Act, most tenant fees are banned.

Fees tenants do NOT pay

- Viewing fees

- Referencing fees

- Inventory fees

- Admin fees

Fees tenants MAY still pay

- Rent

- Deposit

- Holding deposit

- Key replacement (reasonable cost)

- Late rent charges

This has reduced upfront costs compared to pre-2019, but rents have increased instead.

Council Tax Costs for Renters

Council tax is not included in rent unless stated.

Average council tax (Band C–D)

- £140 – £180 per month

Students are usually exempt, but mixed households may still pay.

Outbound link:

https://www.gov.uk/council-tax

Utility Bills for Renters (2026)

Monthly utility costs vary by property size and usage.

Typical monthly bills

- Gas & electricity: £120 – £180

- Water: £40 – £45

- Broadband: £30 – £45

- TV licence: £14.50 per month

Average bills total: £200 – £280 per month

Total Monthly Cost of Renting (Realistic Budget)

When all costs are included:

Single renter (1-bed flat)

- Rent: £900

- Bills & council tax: £250

- Total: £1,150/month

Couple (2-bed)

- Rent: £1,200

- Bills & council tax: £300

- Total: £1,500/month

Family (3-bed)

- Rent: £1,600

- Bills & council tax: £350

- Total: £1,950/month

London figures are significantly higher.

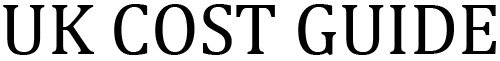

Renting Costs by Region (2026)

Most expensive

- London

- South East

- South West commuter towns

Mid-range

- Midlands

- East of England

- North West cities

Cheapest

- North East

- Parts of Wales

- Northern Ireland

Location remains the biggest cost factor.

Guarantor Requirements and Costs

Many renters are asked for a guarantor.

When guarantors are required

- Low income

- Self-employed

- Students

- Poor credit history

If no guarantor is available, landlords may ask for:

- 3–12 months’ rent upfront (legal but expensive)

Credit Checks & Referencing

Landlords typically require:

- Credit check

- Employment reference

- Previous landlord reference

Failing checks can lead to losing the holding deposit.

How Much Do You Need Saved to Rent?

A realistic savings target:

Outside London

- £2,500 – £4,000

London

- £4,500 – £7,000+

This covers deposit, first month’s rent and moving costs.

Rent Increases During Tenancy

Rent can increase if:

- Clause exists in tenancy agreement

- Section 13 notice is served

- Fixed term ends and renews

Tenants can challenge unfair increases.

Outbound link:

https://www.gov.uk/private-renting/rent-increases

How to Reduce Renting Costs

Practical ways to save:

- Share accommodation

- Move slightly outside city centres

- Negotiate rent (especially renewals)

- Choose unfurnished properties

- Check council tax band

- Avoid short-term lets

Common Renting Mistakes to Avoid

- Not budgeting for bills

- Paying illegal fees

- Not checking deposit protection

- Ignoring break clauses

- Taking properties without inventory

What Renting Will Likely Cost in the Future

Experts expect:

- Continued rent pressure in cities

- Slower increases outside London

- Higher standards but higher rents

- Greater demand for shared housing

Renting will remain a major cost of living issue.

Outbound Links (Official Sources)

Tenant Fees Act guidance:

https://www.gov.uk/government/publications/tenant-fees-act-guidance

Shelter UK renting advice:

https://england.shelter.org.uk

Council tax:

https://www.gov.uk/council-tax

Deposit protection:

https://www.gov.uk/tenancy-deposit-protection

Suggested Internal Links (SEO)

Add these to your site:

- Cost of Living UK 2026 – /cost-of-living-uk-2026/

- Council Tax Cost UK 2026 – /council-tax-cost-uk-2026/

- Water Bill Cost UK 2026 – /water-bill-cost-uk-2026/

- Broadband Cost UK 2026 – /broadband-cost-uk-2026/

- Energy Bill Cost UK 2026 – /energy-bill-cost-uk-2026/