🚗 Car Insurance Cost UK 2026 Guide – By Age

Car Insurance Cost UK 2026 Car insurance remains one of the biggest expenses for drivers in the UK, especially for young or new drivers.

In 2026, car insurance prices continue rising due to:

- Higher repair costs

- Increased theft rates

- More expensive parts for modern vehicles

- Inflation affecting labour costs

This guide breaks down average UK car insurance costs in 2026, especially by age — the biggest factor insurers use.

🔢 Average Car Insurance Cost in the UK (2026)

⭐ Overall Average (All Age Groups): £820 – £1,450 per year

This varies heavily based on age, location, driving history, and type of car.

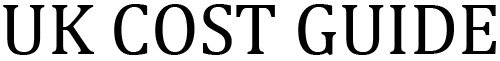

📊 Car Insurance Cost by Age (2026 Breakdown)

Age is the #1 factor in determining insurance premiums.

⭐ Average Annual Price by Age (2026)

| Age | Average Cost (2026) | Notes |

|---|---|---|

| 17-year-old | £2,800 – £4,500 | Highest price bracket |

| 18-year-old | £2,300 – £3,800 | Slight drop after first year |

| 19-year-old | £1,900 – £3,200 | Still expensive |

| 20–21 | £1,500 – £2,500 | Falls slowly |

| 22–24 | £1,100 – £1,900 | More stable |

| 25-year-old | £950 – £1,600 | Big drop at 25 |

| 30-year-old | £750 – £1,250 | Affordable range |

| 35–45 | £680 – £1,100 | Lowest group |

| 50–60 | £650 – £1,000 | Very low risk |

| 70+ | £900 – £1,500 | Prices rise again due to risk |

Young drivers (17–21) remain the most expensive due to inexperience.

Drivers aged 35–55 enjoy the cheapest premiums.

🚙 Insurance Cost by Car Type (2026)

Your car’s insurance group massively affects price.

| Car Type | Typical Annual Cost (2026) |

|---|---|

| Small cars (Fiesta, Corsa, Yaris) | £700 – £1,200 |

| Family cars (Qashqai, Focus, Golf) | £900 – £1,500 |

| Luxury cars (BMW, Mercedes) | £1,500 – £3,500 |

| Sports cars | £2,000 – £6,000 |

| Electric cars | £1,200 – £2,000 |

Electric cars are rising in insurance price due to expensive battery replacement.

📍 Insurance Price by Location (2026)

Postcode affects risk (theft, accidents, population density).

⭐ Most Expensive Areas (2026)

- London

- Birmingham

- Manchester

- Bradford

- Liverpool

⭐ Cheapest Areas (2026)

- Cornwall

- Devon

- Scotland (rural)

- Wales (rural)

- North Yorkshire villages

🔧 What Affects Your Insurance Cost in 2026?

Insurers use multiple factors:

- Age

- Car insurance group

- Postcode

- Driving history

- Mileage

- Occupation

- Credit score

- Type of cover (Comprehensive / Third Party)

- No-claims discount

- Named drivers

- Parking location (street vs driveway)

📉 How to Reduce Car Insurance Cost in 2026

✔ Choose a low-insurance group car

Fords, Toyotas, Hyundais, small hatchbacks.

✔ Add a safe named driver

(Parent or spouse — but not someone who actually drives more than you).

✔ Use black box insurance

Young drivers can save 25%–50%.

✔ Pay annually

Monthly payments include interest (APR up to 40%).

✔ Increase voluntary excess

Save around £80–£200 per year.

✔ Shop around every year

Never auto-renew — always compare.

✔ Reduce mileage

Under 6,000 miles/year = big savings.

✔ Take Pass Plus

Some insurers offer significant discounts in 2026.

🛡️ Comprehensive vs Third Party (2026)

Many believe third party is cheaper — but in 2026:

⭐ Comprehensive insurance is usually cheaper

This is because riskier drivers tend to choose third party policies.

🚘 Cheapest Cars to Insure in 2026

- Toyota Aygo

- Hyundai i10

- Volkswagen Up!

- Vauxhall Corsa (small engines)

- Ford Ka

- Kia Picanto

- Skoda Citigo

Perfect for young drivers wanting cheap premiums.

❓ FAQs — Car Insurance UK 2026

1. What is the average cost of car insurance in the UK in 2026?

£820–£1,450 depending on age and location.

2. Why is young driver insurance so expensive?

Statistically higher accident risk.

3. Does car colour affect insurance?

No — this is a myth.

4. Do electric cars cost more to insure?

Yes — batteries and parts are expensive.

5. Does a dashcam reduce insurance?

Often yes — many insurers offer discounts.

📌 Conclusion

Car insurance prices in the UK continue to rise in 2026.

Costs range from £700 to over £4,000, depending mostly on:

- Age

- Location

- Type of car

- Driving history

To reduce costs, compare insurers, choose low-risk vehicles, use telematics, and avoid auto-renewal.