Introduction

£2,000 a month sounds like a reasonable amount of money. For many people moving to or living in the UK, it feels like it should be enough for a stable and comfortable life.

But when rent, bills, food, and transport are deducted, the picture changes quickly.

So what does £2,000 a month really get you in the UK in 2026?

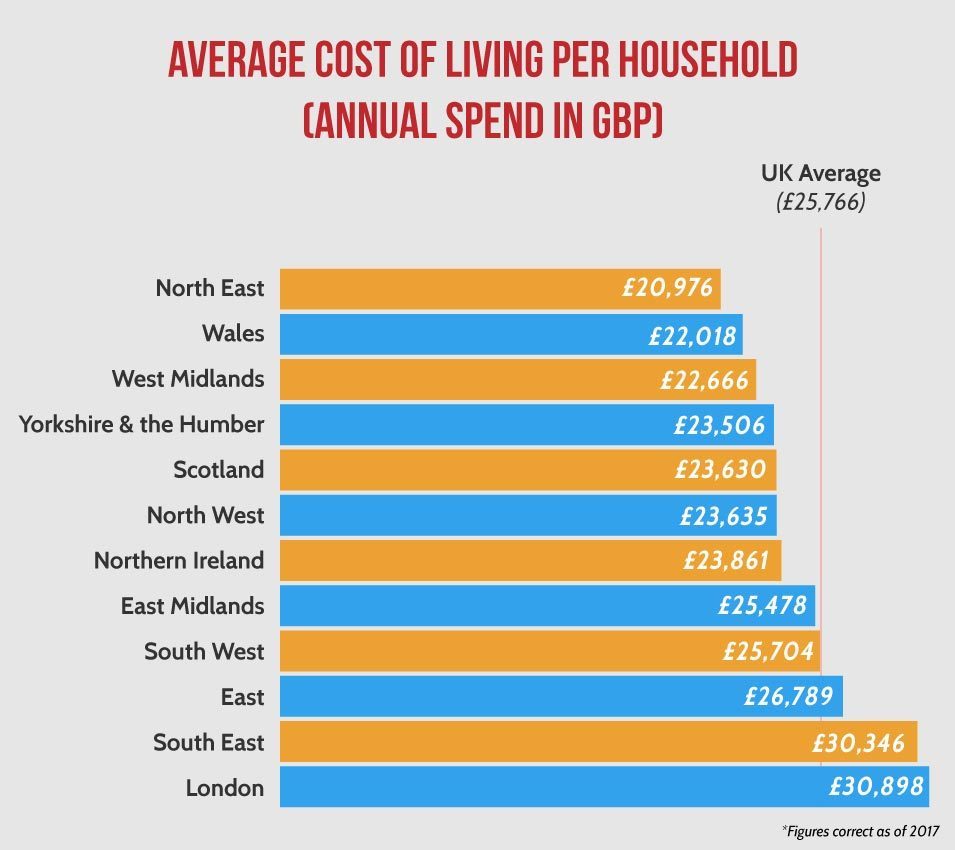

This blog breaks down the real cost of living in the UK, showing where the money actually goes, what kind of lifestyle is realistic, and how location makes a huge difference.

First: What Does £2,000 a Month Represent?

£2,000 a month is typically:

- A take-home salary after tax

- Or a household budget for a single person

- Or a tight family budget in some cases

For many workers, this amount represents:

- Full-time employment

- Average earnings

- Careful budgeting

Let’s see how far it actually stretches.

Rent: The Biggest Expense by Far

Renting in London

If you live in London, £2,000 a month is not comfortable.

Typical costs:

- Room in a shared house: £700–£1,000

- Studio or one-bed flat: £1,300–£1,800+

That leaves very little for everything else.

Reality:

Living alone in London on £2,000 a month is extremely difficult unless housing costs are shared.

Renting in Other UK Cities

In cities like:

- Manchester

- Birmingham

- Leeds

- Nottingham

Rent looks more manageable:

- Room: £500–£750

- One-bed flat: £700–£1,000

Here, £2,000 a month starts to feel possible — but still requires discipline.

Renting in Small Towns

In smaller towns:

- One-bed flat: £500–£700

- Shared housing: £400–£600

This is where £2,000 a month stretches the furthest.

Bills: The Quiet Money Drainers

Even when rent is controlled, bills add up quickly.

Average monthly bills include:

- Council tax: £100–£180

- Gas & electricity: £120–£200

- Water: £25–£40

- Internet & mobile: £40–£60

- TV licence (if applicable): £13

Total bills: £300–£450 per month

These are non-negotiable costs — they exist whether you live cheaply or not.

Food: No Longer “Cheap”

Supermarket Shopping

A realistic monthly food budget:

- Single person: £200–£300

- Couple: £350–£450

Even budget supermarkets feel expensive now. Planning meals and avoiding waste has become essential.

Eating Out

Eating out regularly is not realistic on a £2,000 budget.

Typical costs:

- Takeaway: £10–£15

- Restaurant meal: £20–£30

Most people limit eating out to occasional treats.

Transport: Depends Where You Live

London Transport

Monthly travel costs:

- Public transport: £150–£250

- Car ownership: Very expensive

Transport alone can consume a large portion of income.

Outside London

In smaller cities and towns:

- Bus pass: £50–£80

- Fuel & car costs: £100–£200

Living closer to work makes a big difference.

A Realistic Monthly Breakdown (£2,000)

Here’s a realistic example for someone living outside London:

- Rent: £800

- Bills: £350

- Food: £250

- Transport: £120

- Phone & subscriptions: £60

- Miscellaneous: £120

Total: £1,820

Remaining: £180

That £180 must cover:

- Savings

- Emergencies

- Clothing

- Social life

There is very little margin for error.

Can You Save on £2,000 a Month?

Short Answer: A Little — If Nothing Goes Wrong

Savings on this budget are:

- Small

- Slow

- Fragile

Most people save:

- £50–£150 per month

- Only when no emergencies occur

One unexpected expense can wipe out months of savings.

Lifestyle Reality on £2,000 a Month

What You CAN Do

- Pay bills on time

- Eat properly at home

- Travel locally

- Enjoy occasional treats

What You CAN’T Easily Do

- Live alone in London

- Save aggressively

- Travel frequently

- Handle major emergencies comfortably

This is a survival-plus lifestyle, not a luxury one.

£2,000 a Month for Families

For families, £2,000 a month is extremely tight.

Challenges include:

- Childcare costs

- School expenses

- Larger housing needs

In most cases, £2,000 is not enough without:

- Benefits

- Second income

- Family support

£2,000 a Month for Immigrants

Immigrants often face extra costs:

- Sending money home

- Visa fees

- Setting up life from scratch

This makes the cost of living in the UK even harder to manage on this budget.

Why £2,000 Feels Less Than It Used To

People often ask: “Why doesn’t £2,000 go far anymore?”

Because:

- Housing costs have risen faster than wages

- Bills have increased sharply

- Food prices have changed permanently

The number stayed the same — the value didn’t.

Is £2,000 a Month Enough in the UK?

YES, If:

- You live outside London

- You share housing

- You budget carefully

- You accept a simple lifestyle

NO, If:

- You live alone in a major city

- You have dependants

- You expect comfort and savings

- You want frequent travel or luxuries

The Emotional Reality of This Budget

Living on £2,000 a month often means:

- Constant calculation

- Limited spontaneity

- Background financial stress

It’s manageable — but mentally tiring.

Final Thoughts

The cost of living in the UK means that £2,000 a month is no longer a comfortable income — it is a controlled, careful one.

It provides:

- Stability

- Basic comfort

- Predictability

But not:

- Financial freedom

- Strong savings

- Lifestyle flexibility

£2,000 a month can support a life in the UK — but only if expectations are realistic and spending is disciplined.

The UK today rewards planning, restraint, and patience, not comfort by default.