Cost of Living UK (2026 Guide)

The cost of living remains one of the biggest concerns for UK households in 2026. Prices for food, energy, rent and transport continue to rise faster than wages in many areas, creating pressure for families and individuals.

This guide breaks down what’s gone up, what’s stabilising, and how much the average household spends in 2026 — plus practical ways to lower your monthly costs.

1. What’s Driving the Cost of Living in 2026? Cost of Living UK

The main reasons behind rising UK costs are:

- Higher global energy prices

- Increase in housing demand

- Supply chain pressures

- Food production costs

- Rising council budgets and local tax increases

- Higher interest rates affecting mortgages and rent

Even though inflation has slowed compared to 2022–2023, prices remain high.

2. Energy Bills in 2026

The average household pays:

- £1,600 – £1,900 per year (combined gas + electricity)

- Around £130 – £160 per month

Standing charges remain high, and electric-only homes pay even more.

Full guide:

Energy Bill Cost UK 2026 – /energy-bill-cost-uk-2026/

3. Food Prices in 2026

Food inflation has slowed, but overall prices are still 12–18% higher than 2023.

Typical 2026 prices:

- Milk: £1.40–£1.60

- Bread: £1.20–£1.50

- Chicken: £4.50–£6/kg

- Eggs: £2–£2.50 per dozen

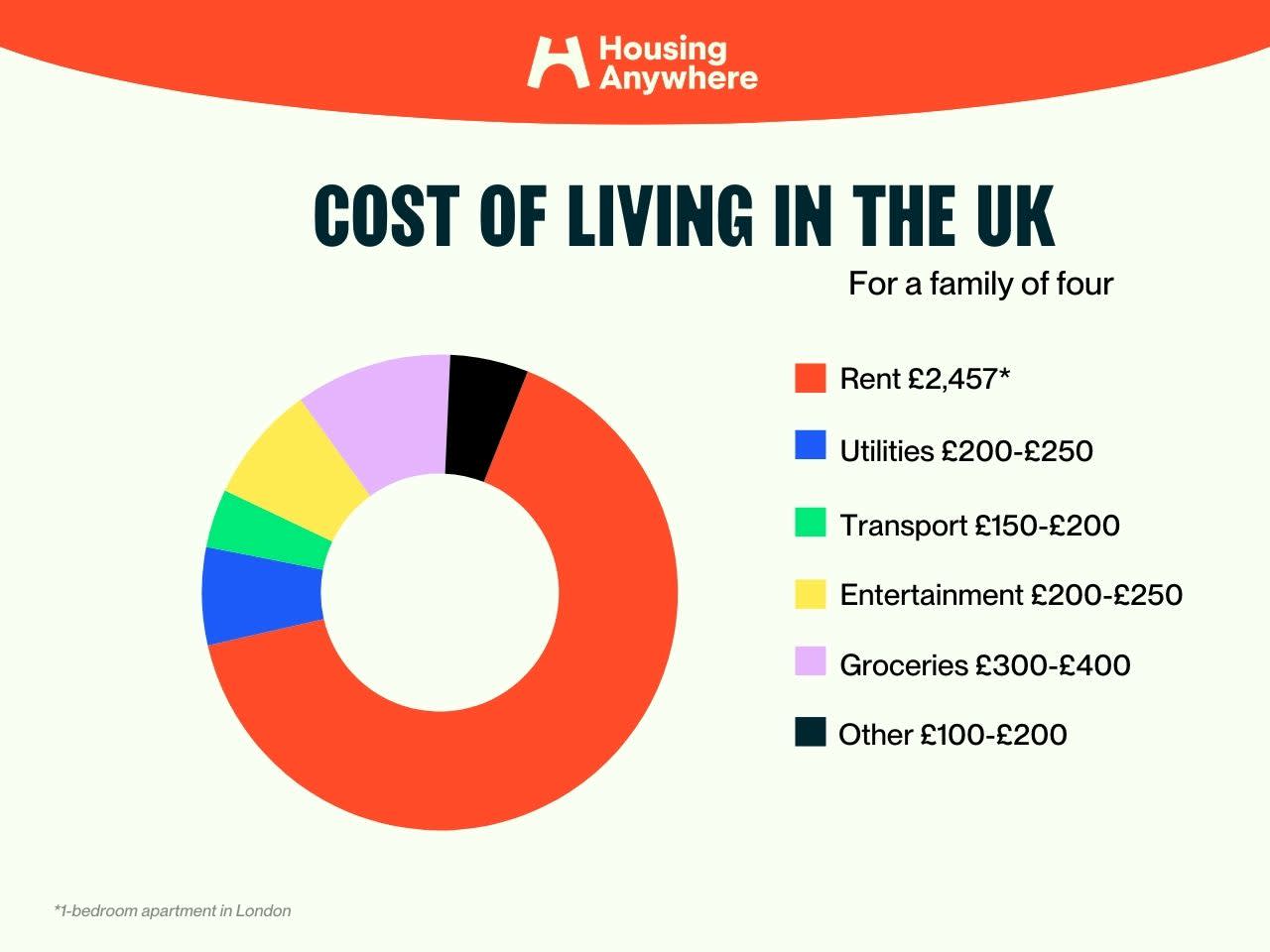

Average monthly food shop (family of 4):

£380 – £520 per month

4. Rent & Housing Costs (2026)

Rent remains one of the fastest-rising costs:

- Average UK rent: £1,050 – £1,350 per month

- London: £1,900 – £2,600 per month

- Northern England: £700 – £950 per month

House prices have stabilised, but mortgage payments remain high due to interest rates.

5. Transport & Fuel Costs (2026)

- Petrol: 145–160p per litre

- Diesel: 155–170p per litre

- Car insurance: up 20–35% vs last year

- Road tax: varies by emissions (see full guide below)

Full guide:

Road Tax Cost UK 2026 – /road-tax-cost-uk-2026/

6. Council Tax in 2026

Most councils have increased rates by 4–5%.

Average Band D bill:

£1,800 – £2,000 per year

Full guide:

Council Tax Cost UK 2026 – /council-tax-cost-uk-2026/

7. Water Bills (2026)

Average water + sewerage:

£470 – £520 per year

Some areas are paying record highs due to infrastructure upgrades.

Full guide:

Water Bill Cost UK 2026 – /water-bill-cost-uk-2026/

8. Broadband & Mobile Costs (2026)

Broadband average:

£28 – £45 per month

Mobile phone contracts:

£20 – £65 per month depending on handset and network.

9. Childcare Costs (2026)

Childcare is one of the biggest burdens:

- Nursery full-time: £900 – £1,500 per month

- Childminders: £4.50 – £7.50 per hour

- After-school clubs: £50 – £100 per week

10. Practical Ways to Reduce Your Cost of Living (Real Savings)

1. Switch to off-peak energy tariffs

Can reduce bills by 20–40%.

2. Challenge your Council Tax band

Many homes are placed incorrectly.

3. Switch broadband & mobile every 12–24 months

New customer deals save £120–£250/year.

4. Use supermarket loyalty & budget ranges

Cuts food bills by £50–£100/month.

5. Apply for available support

Such as the Warm Home Discount or childcare funding.

6. Avoid auto-renew on insurance

Shops around save 30–40%.

7. Install water-saving devices

Free from most water suppliers.

11. Related UK Cost Guides

To improve SEO, link to these pages: